What is the tax credit?

Investing in web accessibility and complying with the Americans with Disabilities Act (ADA) now entitles businesses to a tax credit according to Section 44 of the IRS Code. This is great news for any business that invests in an accessible website and offers an inclusive user experience to people with disabilities.

It's not only for websites. For example, the credit received by the business can be used for the removal of architectural barriers in facilities and the purchase of assistive equipment or services such as sign-language interpreters, the production of accessible formats, or in some cases, the hiring of consulting services.

How much is the credit?

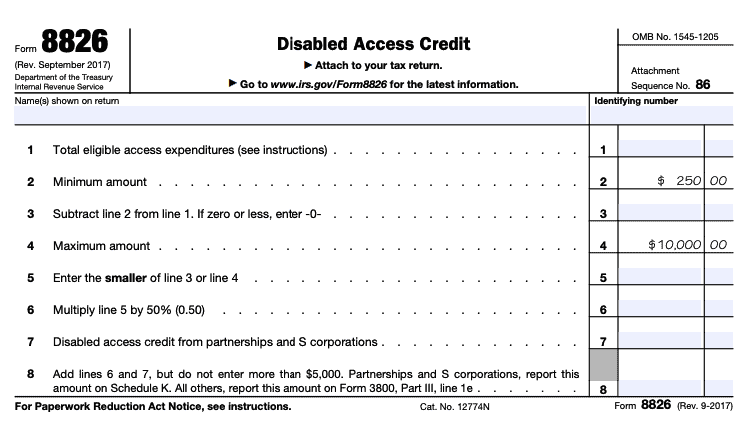

The tax credit covers 50% of the eligible access expenditures made during the previous tax year, with a maximum expenditure limit of $10,250. There is no credit for the first $250 of the expenditures, so it is subtracted accordingly. Therefore, the highest amount of credit a business can receive is $5,000.

Who is eligible?

Under Section 44 of the IRS Code, The Disabled Access Tax Credit is available to any business with a total revenue of $1,000,000 or less in the previous tax year or 30 or fewer full-time employees.

The ADA tax credit benefit is for businesses that generated $1,000,000 or less during the year prior to filing or businesses that employs fewer than 30 employees.

What is website accessibility?

Website accessibility refers to the degree to which people with disabilities can use a website. This includes people who are blind or have low vision, deaf or hard of hearing, limited mobility, and/or any other disability that makes using a website difficult.

There are many ways to make a website accessible, but some components include:

- Adding alt text to images

- Testing font size

- Analyzing color contrasts

- Providing transcripts of audio/video content

- Adding captions to video content

- Tagging fields for screen readers

- Updating tab order for keyboard navigation

- Layout adjustments

- Adjusting page structure

- Cleaning up the navigation hierarchy

Making your website accessible can help you reach a larger audience and comply with laws and regulations.

Benefits of an accessible website

There are many benefits to having an accessible website, including the following:

- Reach a larger audience: Approximately 1 in 4 adults in the US have a disability. By making your site accessible, you're opening up your business to a whole new group of potential customers.

- Comply with laws and regulations: In the US, there are laws like the Americans with Disabilities Act (ADA) that require businesses to provide equal access to people with disabilities. Making your website accessible can help you avoid penalties and lawsuits.

- Improve SEO: Search engines like Google consider accessibility when ranking websites, so making your site accessible can sometimes improve your search engine optimization (SEO).

- Boost morale: Creating an inclusive environment can help boost employee and customer morale.

How do you apply?

To start, please refer to the Tax Incentives for Improving Accessibility Fact Sheet, which provides facts on the tax credit. Then please visit the IRS website to find the most updated version of the fact sheet.

Visit the IRS government website for Form 8826, where you can also research the rules and stipulations regarding the tax credit itself. More instructions can also be found on page 2 of Form 8826. You can also read more on the IRS Tax Credits and Deductions page on the Americans with Disabilities Act website.

Once you have confirmed that your business is eligible, fill out and submit Form 8826 with your tax return.

What next?

- Talk to a CPA or a tax professional to see if this is a good fit for you. As a reminder, we are not accountants and are not providing financial advice.

- Reach out and have us run an accessibility audit (at no charge to you).